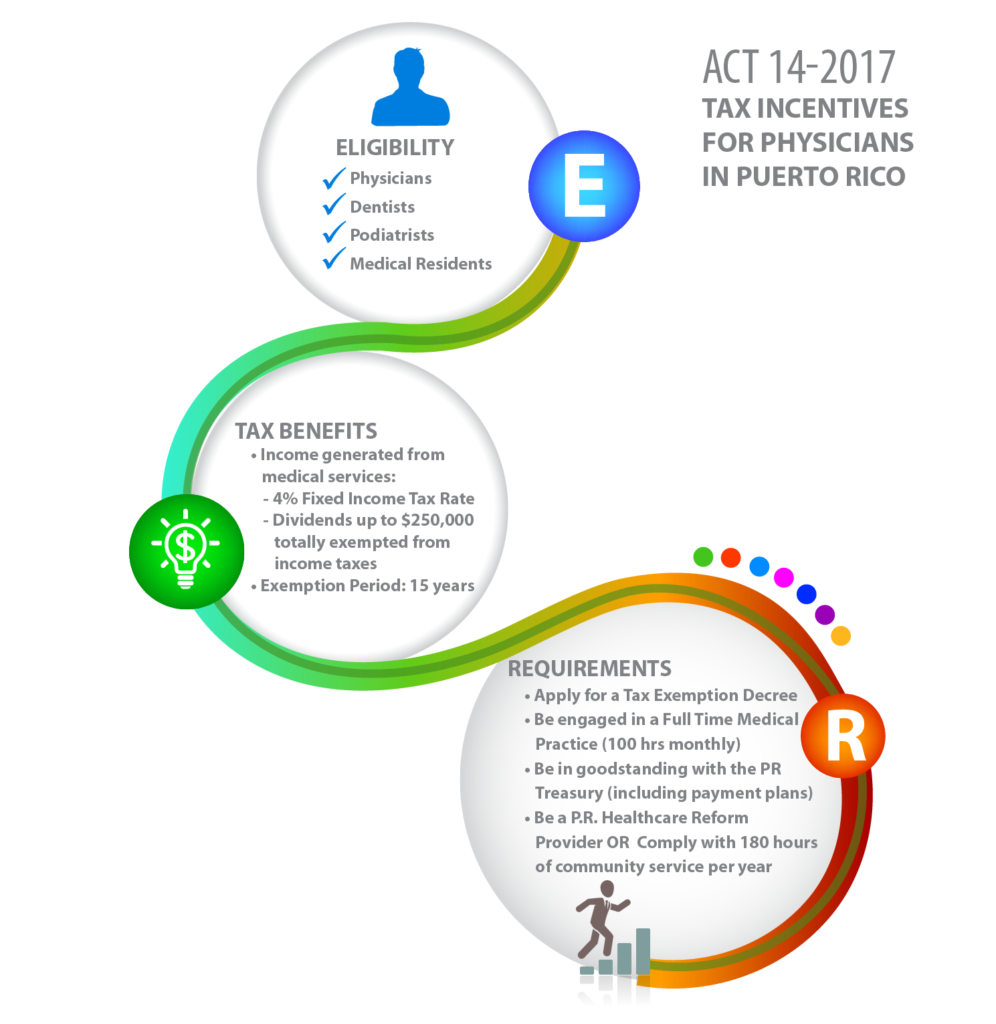

Act 14-2017

Tax Incentives for Physicians in Puerto Rico

Act 14-2017- Tax Incentives for Physicians in Puerto Rico

Example- For illustrative purposes only

|

Net Taxable Medical Income |

Current Tax

(No Decree) |

Tax with Exemption Decree under Act 14 | Annual Tax Benefit | Estimated Tax Benefit during 15 years exemption period |

| $25,000 | $1,134.88 | $1,004.25 | $130.63 | $1,959.45 |

| $41,500 | $3,430.00 | $1,660.00 | $1,770.00 | $26,550.00 |

| $61,500 | $8,430.00 | $2,460.00 | $5,970.00 | $89,550.00 |

| $80,000 | $14,535.00 | $3,200.00 | $11,335.00 | $170,025.00 |

| $100,000 | $21,135.00 | $4,000.00 | $17,135.00 | $257,025.00 |

| $250,000 | $70,635.00 | $10,000.00 | $60,635.00 | $909,525.00 |

| $500,000 | $153,135.00 | $20,000.00 | $133,135.00 | $1,997,025.00 |