Act 135-2014

Incentives Act for Young Entrepreneurs and Startups

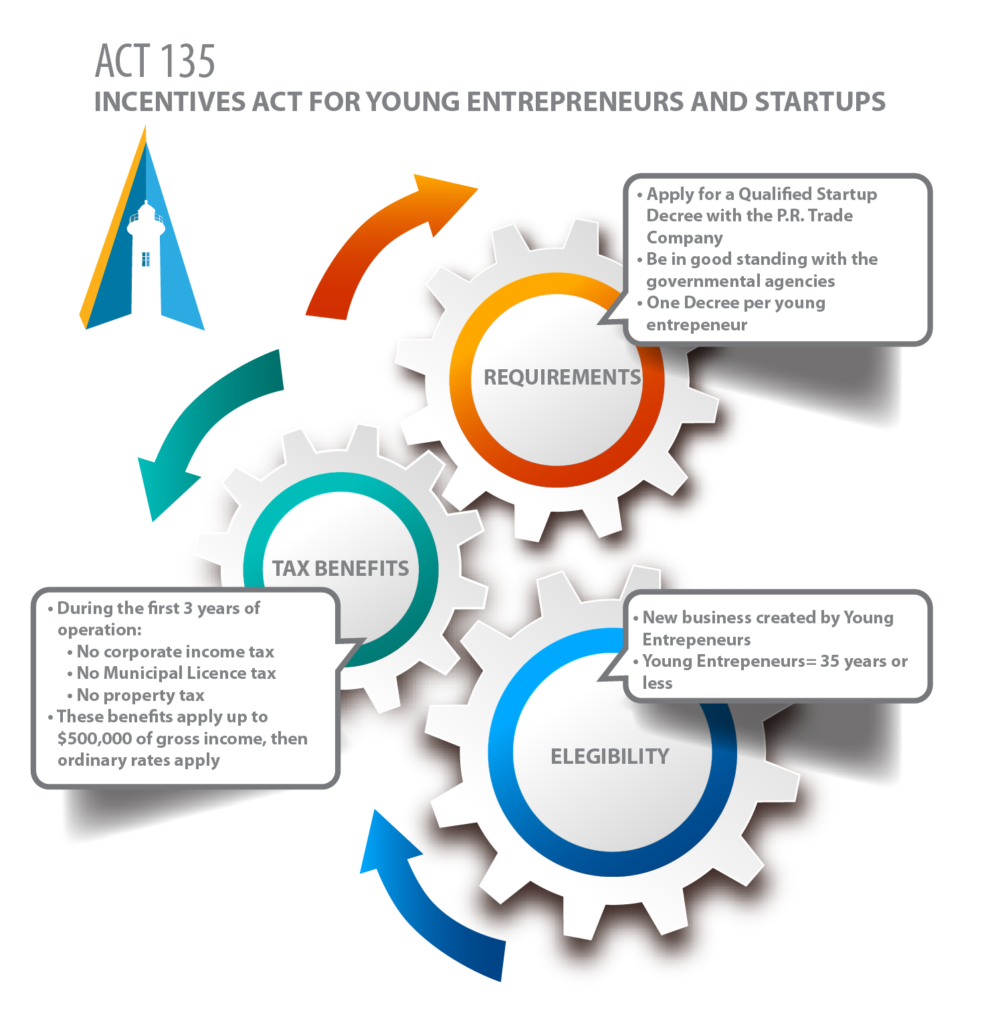

What most entrepreneurs don’t know is that there are other programs that make Puerto Rico one of the most competitive places on Earth to develop your start-up. During her tenure as an advisor to the Governor in 2014, our senior partner, Ana Montañez, was tasked with drafting legislation aimed at retaining and attracting young talent and increase the competitiveness of young startups. Act 135-2014 was approved to suit those needs and provides a qualifying business with the following benefits:

- 0% tax rate on the first $500,000 of revenue for the business during the first 3 years.

- No distinction of whether the income is obtained as an export business or aimed at the local market.

- Municipal license tax exemption during the first 3 years

- Property tax exemption during the first 3 years